In October 2015, Fannie Mae announced that they would start using Trended Data in their underwriting decision starting the weekend of September 24th, 2016. Trended Data will come from Transunion’s CreditVision and Equifax’s TotalView product lines. At this time, Experian has no trended credit data for mortgage credit reporting origination. CIC Credit is ready for testing and the September 24th, 2016, change.

What is trended credit data?

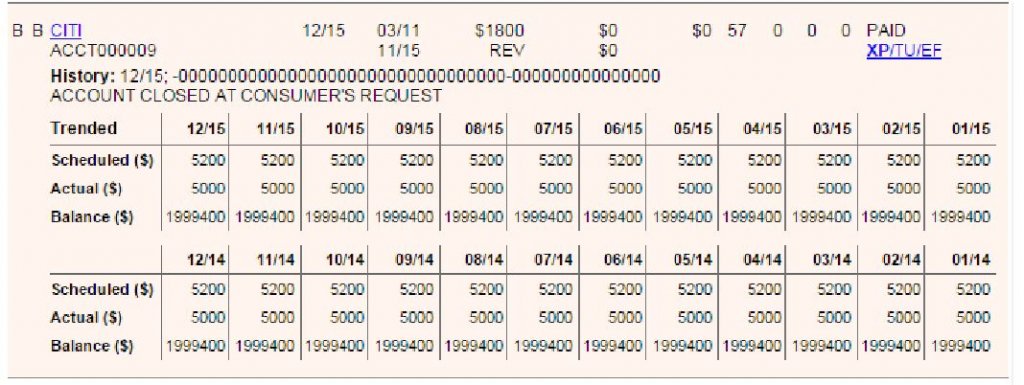

Trended credit data provides an expanded, more granular view of the consumer by leveraging 24 months of a consumer’s past balance, payment, and credit utilization history. It provides a fuller picture of a consumer’s credit behavior, supplementing the traditional moment-in-time credit snapshot with a more dynamic 2-year view of a consumer’s history of managing revolving accounts. With 24 months of historical data (such as payment and balance), lenders may be able to see how consumers have managed their credit accounts over time, allowing them to predict future behavior better and assess risk. For example, a consumer with a large credit card balance who pays in full every month (a “transactor”) likely has a higher level of creditworthiness than a consumer with a large credit card balance who only makes the minimum required payment (a “revolver”). Existing credit reports can’t always differentiate between these two types of consumers.

Why is this change coming?

This new trended credit data initiative could significantly change the mortgage lending industry and the evaluation of home loan applicants. The trended credit data from TransUnion & Equifax will enhance the static snapshot of a consumer’s credit balances with 24 months of historical payment data, potentially providing a more comprehensive view of the applicant. Equifax Trended ACROFILE® & TransUnion CreditVision® is the new industry to mortgage end users.

When Fannie Mae integrates trended credit data into Desktop Underwriter® (DU®), will Experian participate as well?

Experian will participate, but we have no ETA at this point.

Will this data have an effect on the DU credit risk assessment and how information is returned to my lender by Fannie Mae?

Our understanding is trended credit data will be included as part of the credit risk assessment in DU Version 10.0 (to be released the weekend of September 24th, 2016). Refer to Fannie Mae’s DU Version 10.0 Release Notes for additional information.

Will Freddie Mac accept the new trended tri-merge data in Loan Prospector®?

At this time, Freddie Mac will not receive the new data elements in machine-readable formats; however, they should still receive the new tri-merge human readable print images embedded within the machine readable (XML or .dat and FFF raw file) formats.

Will the way clients order credit reports today change?

No. The process of ordering credit reports will remain the same as always.

Do I need to make system changes to address Freddie Mac’s requirements?

If you have a proprietary system with a direct connection to Freddie Mac, please review with Freddie Mac directly. They can discuss technical requirements to support Freddie Mac.

Why do some tradelines have the trended credit data but others do not?

Not all tradelines qualify. Refer to the criteria chart for Equifax tradelines below.

Trended Credit Data May Not Be Present for These Accounts:

- Authorized user

- Child or family support

- Collections

- Duplicate trade

- Insufficient information to Score /(file contains no trade, inquiry, collection, or public record)

- Less than 6 months of history in an open status

- Lost or stolen

- Masked trade data for certain narrative codes (bankruptcy, in dispute, medical, repossession, foreclosure, etc.)

- Medical

- Greater than 24 months since last reported

- Public records

- Subject is deceased

- System reject (model delivery is temporarily unavailable)

Do the balances shown reflect the balance before or after the monthly payment?

Trended credit data indicates the balance after the monthly payment was made as reported by the data furnisher for the applicable tradeline.

Can additional months of trended credit data be requested (beyond what is provided in the report)?

Trended credit data is only available for 24 months at this time.

What would be reflected in the trended credit data if a consumer missed a payment?

Trended data will indicate a BLANK or ZERO depending on how the data furnisher supplied the information.

When will trended credit data be available in MISMO?

Our understanding is MISMO has added containers for trended credit data in their 3.4 version; however, they are actively reviewing a possible solution for MISMO 2.3 with more information expected soon.

Will a Rescore include trended credit data as well?

No. Trended credit data is not included in the mortgage industry credit scores; therefore, our Rescore product will not be impacted. Making changes to the trended credit data fields would not impact scores, yet this will be revisited in the future if/when the mortgage industry scores start using trended credit data.

Will Trended Data increase my credit report fees?

Yes, Trended Data will add a significant increase to credit report fees and secondary use fees also.

How is the data going to display? What will the report look like?

In October 2015 Fannie Mae announced that they will start using Trended Data in their underwriting decision starting the weekend of September 24th 2016. Trended Data will come from Transunion’s CreditVision and Equifax’s TotalView product lines. At this time, Experian has no trended credit data for mortgage credit reporting origination.