Key Points

- It seems likely that credit industry initiatives, including medical debt reporting, trigger leads, and FHFA credit score updates, are currently delayed due to regulatory and legal challenges.

- Research suggests the CFPB’s rule to remove medical debt from credit reports is postponed to June 15, 2025, amid lawsuits, affecting how credit reports are compiled.

- The evidence leans toward the FCC’s one-to-one consent rule for trigger leads being delayed to January 26, 2026, impacting lender access to potential borrowers.

- The FHFA’s credit score initiative, aiming for fairer models, faces opposition from lenders, with implementation timelines now uncertain, possibly extending to 2026.

Introduction

As Mike Thomas, COO of CIC Credit, I’m sharing my perspective on the current state of credit industry initiatives, focusing on medical debt, trigger leads, and the FHFA credit score initiative. These areas are experiencing delays due to regulatory changes and legal battles, which are shaping how we operate and serve our clients.

Medical Debt

The Consumer Financial Protection Bureau (CFPB) has proposed removing all medical debt from credit reports to protect consumers from unfair practices. This rule, amending the Fair Credit Reporting Act (FCRA), was meant to take effect earlier, but lawsuits from the Consumer Data Industry Association (CDIA) and the American Collection Association (ACA) have delayed it to June 15, 2025. There’s ongoing litigation, and with Jonathan McKernan nominated as the new CFPB director on February 11, 2025, his stance remains unclear. At CIC Credit, we support consumer protection but must ensure our reports remain accurate, especially for mortgage lending, as this change could alter creditworthiness assessments.

Trigger Leads

Trigger leads help lenders identify potential borrowers, but the FCC’s “one-to-one consent rule” now requires individual consumer consent before sharing information, complicating the process. This rule’s implementation, initially set, has been pushed to January 26, 2026, by the 11th District Court, with a legal challenge from the Insurance Marketing Coalition Limited (IMC) against the Federal Trade Commission (FTC). For CIC Credit, this means higher costs and complexity in generating leads, and we’re working with partners to adapt while complying with the law.

FHFA Credit Score Initiative

The Federal Housing Finance Agency (FHFA) released a “Playbook” in January 2025 to update credit scoring models for fairness in mortgage lending, initially targeting full implementation by Q4 2025. However, lender opposition, particularly to the bi-merge option, has created uncertainty, potentially delaying it to 2026 or later. With leadership changes, including Sandra Thompson’s departure and Bill Pulte’s nomination, the timeline is unclear. CIC Credit is preparing to integrate these models, aligning with our commitment to fair reporting, but the delays make planning challenging.

Detailed Analysis of Credit Industry Initiatives

As Mike Thomas, COO of CIC Credit, I’ve been closely monitoring the evolving landscape of credit industry initiatives, particularly in the areas of medical debt, trigger leads, and the FHFA credit score initiative. These topics are critical to our operations and the services we provide to mortgage lenders, banks, and other financial institutions. Below, I’ll dive into the details, drawing from recent developments and their implications for CIC Credit, ensuring a comprehensive overview for our customers.

Background and Context

The credit industry is currently at a crossroads, with several initiatives facing delays due to regulatory changes and legal challenges. These delays stem from efforts to enhance consumer protection and fairness, but they also introduce operational complexities for credit reporting agencies like CIC Credit. My analysis focuses on three key areas: medical debt reporting, trigger leads, and the FHFA’s efforts to update credit scoring models. Each of these initiatives has significant implications for how we compile and deliver credit reports, and I’ll explore their current status, challenges, and potential future impacts.

Medical Debt: Regulatory Shifts and Legal Battles

One of the most notable developments is the CFPB’s rule to remove all medical debt from credit reports. This initiative, which amends Regulation V under the Fair Credit Reporting Act (FCRA), aims to protect consumers from the unfair reporting of medical debts, which can disproportionately affect credit scores. The rule was initially set to take effect, but due to lawsuits filed by the Consumer Data Industry Association (CDIA) and the American Collection Association (ACA), the implementation has been postponed. According to recent updates, the new effective date is June 15, 2025, with litigation delays extending considerations until May 12, 2025.

The nomination of Jonathan McKernan as the new CFPB director on February 11, 2025, adds another layer of uncertainty. His stance on medical debt reporting is not yet known, which could influence the rule’s enforcement. For CIC Credit, this means we must prepare for potential changes in how credit reports are compiled, especially given our role in serving mortgage lenders. Removing medical debt could alter how creditworthiness is assessed, potentially affecting loan approvals and interest rates. We support efforts to protect consumers, but we also need to ensure our reports remain comprehensive and accurate, balancing these competing priorities.

Trigger Leads: Consent Requirements and Implementation Delays

Trigger leads are a vital tool for lenders whether one agrees with the practice or not, allowing them to identify potential borrowers based on credit inquiries. However, the FCC’s “one-to-one consent rule” has introduced new requirements, mandating that consumers must individually consent to having their information shared with lenders. This rule, designed to enhance consumer privacy, has faced implementation delays. The 11th District Court has postponed its enforcement to January 26, 2026, following a legal challenge by the Insurance Marketing Coalition Limited (IMC) against the Federal Trade Commission (FTC).

FHFA Credit Score Initiative: Fairness vs. Implementation Challenges

The Federal Housing Finance Agency (FHFA) has been working on updating credit scoring models used in mortgage lending, releasing a “Playbook” in January 2025 to outline these changes. The initiative aims to promote fairness and accuracy, particularly for underserved populations, with an initial target for full implementation by the fourth quarter of 2025. However, opposition from lenders, especially regarding the bi-merge option, has created significant hurdles. The bi-merge option, which uses data from two credit bureaus instead of three, has been a point of contention, with lenders arguing it could reduce accuracy and create a new required score model provided by VantageScore.

Recent developments suggest the timeline is now uncertain, with potential delays pushing implementation to 2026 or later. Leadership changes within the FHFA, including Sandra Thompson’s departure and Bill Pulte’s nomination, add to the complexity. For CIC Credit, this initiative aligns with our commitment to providing fair and accurate credit reports. We’re preparing to integrate any new scoring models once finalized, but the uncertainty makes planning challenging. We’re monitoring the situation closely, ensuring we can adapt our systems to meet the needs of our clients while complying with regulatory requirements.

Comparative Analysis: Status and Implications

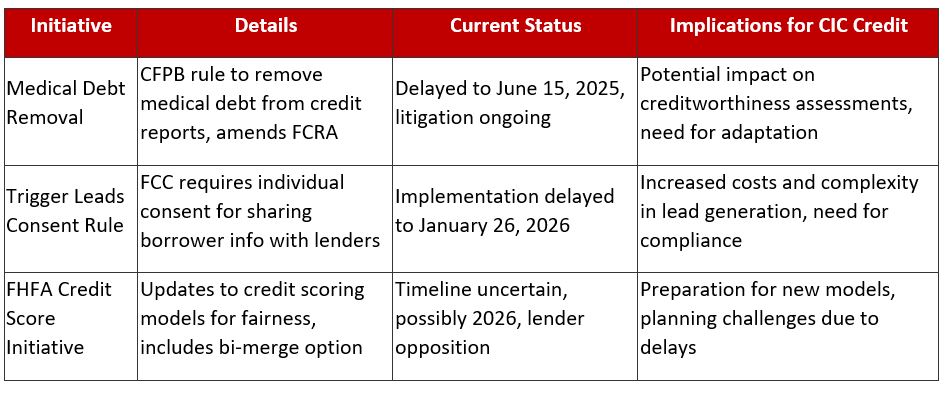

To provide a clearer picture, here’s a table summarizing the current status of these credit industry initiatives:

This table highlights the interconnected nature of these initiatives and their impact on our operations. Each delay introduces uncertainty, but it also provides opportunities for CIC Credit to refine our processes and strengthen our offerings.

Forward-Looking Statements

As we navigate these challenges, CIC Credit remains committed to delivering reliable, compliant, and innovative credit reporting services. We’re actively engaging with industry stakeholders, monitoring regulatory developments, and preparing for various scenarios. The credit industry is resilient, and while progress may be paused for now, I’m confident that these initiatives will ultimately lead to a more transparent and consumer-friendly system. We’ll continue to communicate transparently with our clients, ensuring they’re informed and supported through this period of change.

Conclusion

In summary, credit industry initiatives related to medical debt, trigger leads, and the FHFA credit score update are currently on hold, driven by regulatory shifts and legal battles. For CIC Credit, these delays mean adapting to new compliance requirements, managing operational complexities, and planning for uncertain timelines. We’re ready to meet these challenges head-on, leveraging our expertise to serve our clients effectively. Stay tuned for further updates as these initiatives evolve.

Mike Thomas, COO

02/24/2025