learn about our history

Who is CIC

Better Business decisions

start with

CIC

We have successfully established ourselves within the credit reporting

business since 1921. With years of combined credit related experience, we

provide a vast variety of highly advanced credit tools and resources that can

be tailored to specifically suit your needs.

At CIC, we are also well diversified and offer a variety of professional services

and products within the verification, fraud detection, and screening business.

With the use of our screening experts and innovative technology, we have the

capability to ensure industry regulations are being met, while helping you

protect your identity, property and businesses.

01

Reliability

We are known for providing accurate and dependable credit information, identity protection, and verification services, instilling confidence in clients and users.

02

Innovation

We display a commitment to technological advancements and innovative solutions, ensuring that our services remain cutting-edge and effective in a dynamic financial landscape.

03

Client Focused

We prioritize customer satisfaction, offering personalized and responsive services, and demonstrating a strong commitment to meeting the unique needs of our clients.

Helping our clients close more loans, hire qualified employees, and find qualified tenants with quality reports and service.

How we got started

Since 1921

For over 100 years, CIC Credit has possessed a diverse range of highly advanced tools and resources. Established in Nashville, TN in 1921. In the 1960’s CIC became an Equifax affiliate. Re-branding in the 90’s to become the Credit Information Center, and then ten years later becoming an independent credit reporting agency and part of Meeker Enterprises. In 2006, screening products were added to the product offerings, and in 2008, CIC rebranded to become the company known today, CIC Credit.

your pathway to exceptional support

customer Service

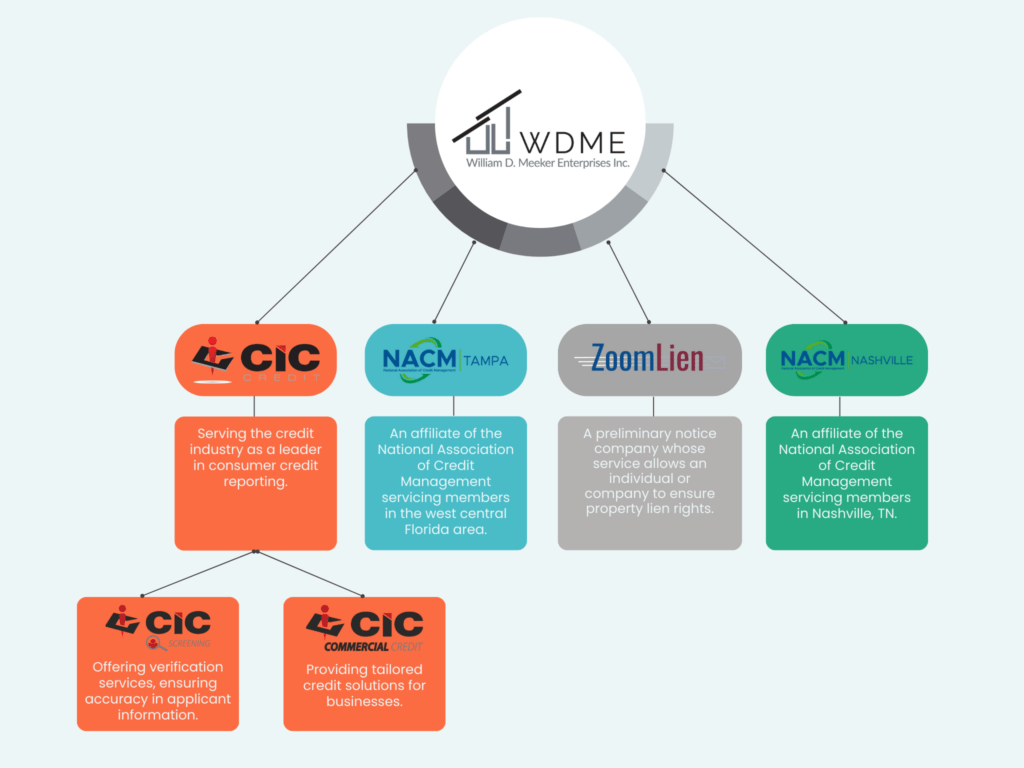

CIC Credit is part of WDME

William D. Meeker Enterprises, WDME, is an employee owned ESOP company. Our offices are located in Tampa, FL and Nashville, TN. We offer a full spectrum of solutions to your credit needs across our four operating companies. We are committed to providing unparalleled customer service and being the technology leader in our industry.

Tailored Solutions

Responsive Support

What areas does your team focus on?

we work hard

In Various Domains

Whether you’re in need of mortgage credit reports or single bureaus for your credit applications, CIC ensures comprehensive coverage through our cutting-edge cloud-based delivery system, ensuring instant and real-time results. Additionally, our award-winning API delivery system enables seamless integration into your customer system or any of the 50+ origination systems available in the market today. Discover how our suite of offerings is meticulously crafted to meet your specific requirements, and let us assist you in ticking all the boxes.

Credit

Products

Property & Valutation

Fraud

Verification

our team of experts are here for you

Get to know the faces behind our success! Explore and meet our dedicated team, each passionate about delivering excellence and committed to your satisfaction.

important things you should know

Questions And Answers

A credit file disclosure, or credit report, contains all the information in your credit file maintained by a consumer reporting company. This information can be provided to third parties, like lenders. It includes details on everyone who has recently accessed your consumer report (“inquiries”). The disclosure contains additional information not present in reports provided to third parties, such as inquiries for pre-approved credit offers, account reviews, and suppressed medical account details. Federal and state laws grant you the right to receive a disclosure copy of your credit file from a consumer reporting company.

In order to align your screening programs with both Federal and State regulations, as well as company-specific guidelines, we collaborate closely with industry experts and consult with our CIC Credit clients on sales approaches. Our support includes a comprehensive, step-by-step guided process during setup and training. Additionally, our committed service team delivers monthly and quarterly management reports to ensure ongoing compliance and effectiveness.

CIC has special programs and technology in place to help clients stay compliant with industry regulations, EEOC guidelines, FCRA, FACTA Act, SAFE Act, DOT Regulations, GSE’s regulations, and the Sarbanes-Oxley Act.

CIC Credit prioritizes the security of sensitive information throughout the compliance process. Our systems are equipped with robust security measures, encryption protocols, and strict access controls to safeguard client data, ensuring confidentiality and compliance with data protection standards.

Certainly! CIC Credit welcomes your inquiries at any time. Our dedicated support team is ready to assist you and address your needs whenever you reach out, ensuring a responsive and reliable service experience. Feel free to contact us whenever you require assistance or have questions—we’re here to help around the clock.

CIC Credit’s service team offers comprehensive support, guiding you through the entire setup process and providing continuous assistance throughout. Additionally, expect timely updates through our detailed monthly and quarterly credit management reports, ensuring you stay informed about key developments and outcomes.

CIC Credit’s technology and programs are customized to suit your business needs, aiding in compliance with industry regulations, streamlining processes, and providing comprehensive insights to support informed decision-making.

CIC Credit stands out due to its commitment to tailored solutions, cutting-edge technology, and a dedicated service team. We prioritize client needs, ensuring reliable support, and effective strategies for compliance with various industry regulations.